Settlement Planning Services

Call CW Settlements at (800) 453-5414

Injured claimants and their families have unique needs and deserve customized solutions. As a full-service settlement planning firm, our team approaches planning on a case-by-case basis.

When a plaintiff attorney engages one of our consultants early in the settlement process, we have time to build a relationship with the claimant and assess that person’s needs, goals, and any issues that may impact settlement proceeds. We can then provide an individualized plan designed to meet both immediate financial needs and long-term financial security.

Whether your client has suffered an injury or lost a loved one, experienced wrongful termination, or if you are a plaintiff attorney seeking assistance with your own financial needs, we are your single best resource for comprehensive planning.

Structured Settlement Annuities

What is a Structured Settlement?

A structured settlement annuity (“structured settlement”) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers’ compensation settlement in a series of income tax-free periodic payments.

Structured settlements may also be used in non-physical injury settlements so that our clients may receive tax-deferred income instead of receiving an immediate and fully taxable lump sum settlement payment.

A CW Settlements consultant can advise you of various structured settlement annuity options, including:

- Fixed-Indexed Annuities

- Single Premium Immediate Annuities

- Deferred Income Annuities

- Multiple-Year Guarantee Agreements.

How Does a Structured Settlement Work?

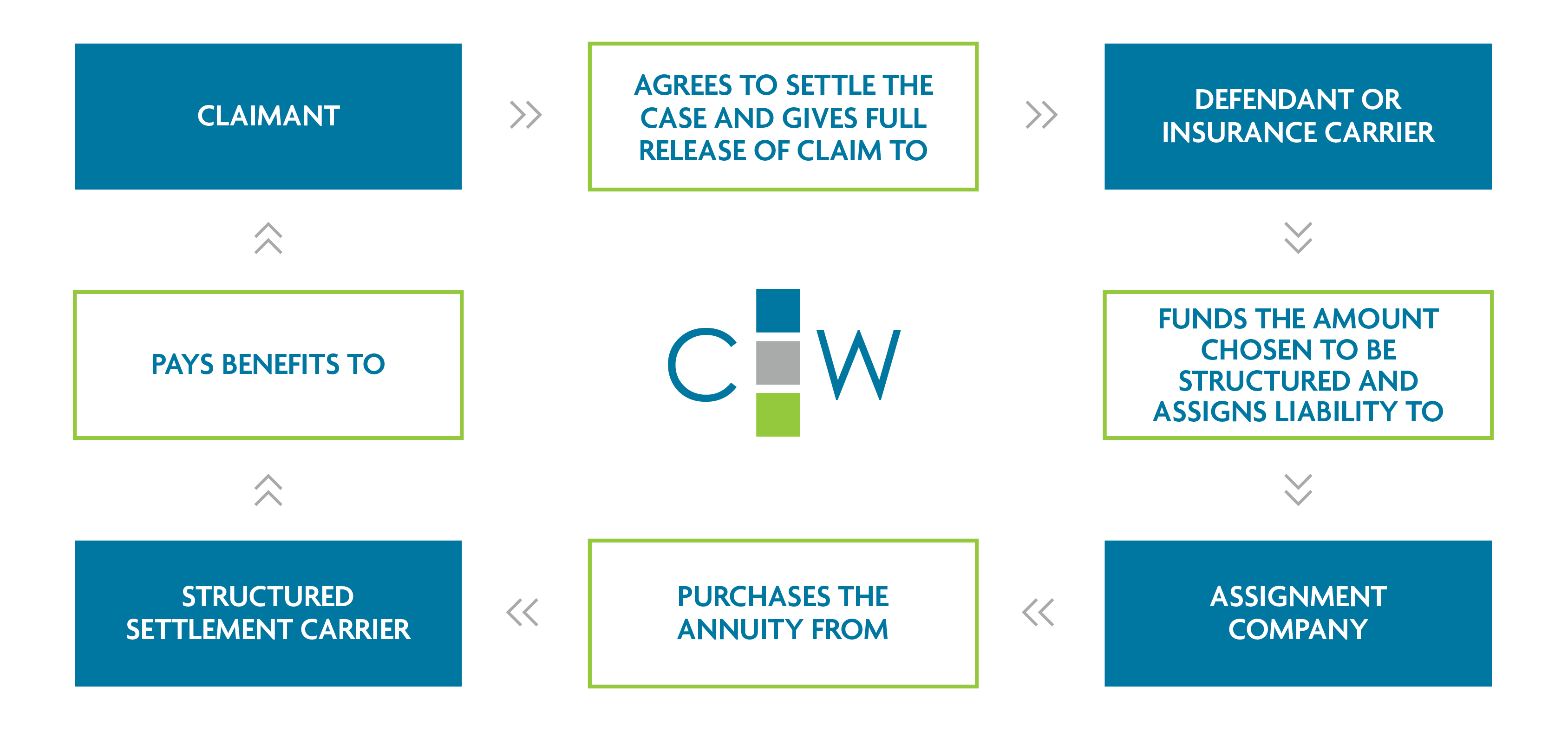

The decision to utilize a structured settlement must be made before finalizing the settlement agreement. Once both parties have agreed to the details of the structured settlement, the claimant releases the defendant (or insurer) from liability.

The defendant or insurer then pays the settlement funds to a third-party assignment company, which assumes liability and purchases an annuity from a structured settlement carrier. The carrier then makes a series of periodic payments based on a previously agreed upon timeline and amount.

Structured settlements may be funded with proceeds from settlements of almost any size; in fact, many structured settlement providers will structure amounts as low as $10,000. The choice is ultimately the claimant’s, and many find that a structured settlement is much more beneficial than a lump sum cash payment.

Benefits of a Structured Settlement

- 100% income-tax-free for physical injury and wrongful death cases:

Payments (including growth) for physical injury and wrongful death cases are free from state and federal income tax under Section 104(a) of the Internal Revenue Code. - 100% income tax-deferred for non-physical injury cases:

Payments (including growth) for non-physical injury cases are tax-deferred. - Guaranteed payments*:

The schedule of payments is determined on the front end of the transaction, resulting in a steady source of safe, reliable income for the claimant.

*Guarantees are subject to the claims-paying abilities of the issuing insurance company. - Guaranteed rate of return:

With a locked-in rate of return, injured claimants can rest assured that market volatility will not affect their structured settlement payments. - No overhead fees or expenses:

The lack of overhead fees combined with the preferential tax treatment allow structured settlements to remain competitive with traditional investments.

Market-Based Structured Settlements

There are additional investment options available to claimants who may not be interested in a structured settlement annuity. To learn more, click on our Market-Based Structured Settlements Tab.

Market-Based Structured Settlements

CW Settlements is committed to providing plaintiff attorneys and their clients with innovative financial solutions. To that end, we work with reputable partners to provide market-based structured settlements as an alternative to life insurance-based structured settlement programs.

Why Choose a Market-Based Structured Settlement?

Many claimants and attorneys find that market-based structured settlements provide the opportunity to receive tax-free income or tax-deferred income while enjoying market-driven growth potential.

Within a market-based structured settlement, there is considerable flexibility of design to allow each individual to address his or her own financial needs. Market-based structured settlements can work in conjunction with structured settlement annuities to create a truly balanced settlement solution.

Settlements Plus™

Settlements Plus™ operates much like a traditional structured settlement, yet with a market-based investment portfolio serving as the financial vehicle, rather than an annuity.

Claimants who elect to place their personal injury settlement proceeds in Settlements Plus™ will enjoy the same income tax-free treatments1 associated with structured settlement annuities.

Claimants who utilize Settlements Plus™ for non-personal injury settlement proceeds will have the opportunity to defer taxes on their payments until the years in which the payments are received. Investments can be managed by a reputable financial institution or by the claimant’s financial advisor.

Fee Structure Plus®

Fee Structure Plus® allows attorneys to invest their contingency fees in a market-based investment portfolio on a tax-deferred basis. As is the case with Settlements Plus™, the funds can be managed by a financial institution or by the attorney’s own financial advisor. Payments will be received on a pre-determined periodic payment schedule, with tax obligation being spread out over the course of the payments.

Treasury Funded Structured Settlement™

A Treasury Funded Structured Settlement™ (TFSS) operates much like a traditional structured settlement, but it uses United States Treasury Bonds as the underlying investment, as opposed to an annuity.

A TFSS can be used by claimants involved in both physical and non-physical injury settlements, as well as by attorneys who wish to defer their contingency fees.

Non-Qualified Structured Settlements

Certain types of settlements do not qualify for income tax exclusion via a traditional structured settlement annuity. Fortunately, a non-qualified structured settlement annuity offers guaranteed1 tax-deferred payments for a wide range of cases.

Non-Qualified Assignment

Non-qualified structured settlements are those that do not qualify for income tax exclusion under Section 104 of the Internal Revenue Code. A non-qualified assignment offers a claimant involved in a non-physical injury case the opportunity to place all or a portion of the settlement proceeds in a structured settlement.

The claimant receives the settlement funds in a series of periodic payments and is liable only for the taxes on the funds received within a given tax year. In the meantime, the pre-tax settlement funds continue to earn interest.

Why utilize a non-qualified structured settlement annuity?

- Defer paying taxes on the lump sum settlement proceeds

- Create a stable, long-term source of income

- Receive guaranteed payments1

Types of Claims

Non-qualified structured settlements can be used to resolve many different types of claims, including, but not limited to:

- Employment litigation (e.g., wrongful termination, sexual harassment, discrimination, and mental anguish)

- Construction defects

- Contract disputes

- Punitive damages

- Environmental claims

- D&O and E&O claims

Market-Based Structured Settlements

In addition to structured settlement annuities, there are other investment options available to claimants involved in non-physical injury settlements. To learn more, click our Market-Based Structured Settlements Tab.

1Guarantees are subject to the claims-paying abilities of the issuing insurance company.

Attorney Fee Deferral Strategies

Plaintiff attorneys have the unique ability to place all or a portion of their contingency fees in several types of tax-advantaged investments. By electing to defer fees, an attorney also defers the tax obligation until the year in which payments are received.

Attorneys can choose to defer fees regardless of whether the claimant structures his or her own settlement proceeds; however, the ability to defer fees must be included in the settlement agreement.

Structured Attorney Fees

To facilitate an attorney fee structure using a fixed income annuity, the defendant (or insurance company) directs the attorney’s fees to a third-party assignment company. The assignment company then uses the fees to purchase a fixed annuity that provides the attorney with payments based on a pre-determined schedule.

Payments are eligible to be electronically deposited into the attorney’s bank account and will be reported on a 1099-MISC as income only during the years in which the payments are received.

Structured attorney fees do not have any ongoing administrative or maintenance fees, so more money stays in the attorney’s pocket. Payment schedules can be arranged for monthly, quarterly, semi-annually, annually, or in a series of future lump sums and can begin immediately or on a future date1.

Tax Guidance for Structured Attorney Fees

Much like a structured settlement annuity for injured claimants, the tax treatment hinges on avoiding constructive receipt. In Childs v. Commissioner, 103 T.C. 634 (1994), aff’d, 89 F. 3d 856 (Table)(11th Cir. 1996), the Tax Court ruled that because the attorney’s fees were transferred from the defendant directly to the assignment company, the attorney did not have constructive receipt of the fees; therefore, the fees did not yet count as taxable income.

Non-Fixed Annuity Options for Attorneys

Attorneys may select from several structured settlement annuity options, in addition to the fixed annuity. Minimums for investment may vary depending on the product, and non-fixed annuity options may include setup and/or annual administration costs.

However, non-fixed annuity options may offer the chance for greater growth than the fixed annuity while still providing guaranteed income. Your CW Settlements structured settlement consultant can provide a thorough consultation regarding your annuity options.

Fee Structure Plus®

Fee Structure Plus® allows an attorney to invest a contingency fee, tax-deferred, in a market-related investment portfolio. The funds can be managed by a respected financial institution or by a financial advisor of the attorney’s choosing. Payments will be received on a periodic payment schedule, with taxes due only on funds received during a given tax year. For more information about market-based investments, click our Market-Based Structured Settlements Tab.

Treasury Funded Structured Settlement™

A Treasury Funded Structured Settlement™ (TFSS) is backed by the United States government and uses U.S. Treasury Bonds as the underlying investment. Attorneys can choose to place all or a portion of their contingency fees in a TFSS for a safe, reliable fee deferral option.

1Payment start date restrictions may vary by issuing insurance company.

Qualified Settlement Funds (468B Trusts)

A Qualified Settlement Fund (QSF), also referred to as a 468B Trust, is an exceptionally useful settlement tool that allows time to properly resolve mass tort litigation and other cases involving multiple claimants. When a QSF is created and funded, the defendant makes a payment into the trust account in exchange for a full release of all claims.

Qualified Settlement Funds: Benefits for Both Sides

In addition to the release of liability, the defendant is eligible to receive an immediate tax deduction for the payment. In the meantime, claimants gain the time they need to receive a proper settlement consultation and to determine their best settlement options.

The additional time also allows for lien resolution and the preparation of required documentation without the time pressures of litigation. Claimants without any outstanding issues will not have to wait for their co-claimants’ issues to be resolved in order to receive their settlement distribution.

Qualified Settlement Fund Services

CW Settlements has built close relationships with industry leaders in qualified settlement fund administration. Services include:

- Preparing all motions, court orders, and documents needed to establish and administer the fund

- Generating client closing statements and providing accounting for the fund

- Disbursement of all claimant payments, including directing funding of Special Needs Trusts and/or structured settlements

- Live call center assistance

- Attorney fee and expense disbursement

- Executing qualified assignments

- Managing payment of finalized liens

- Printed educational materials for claimants

- National bankruptcy and probate coordination

- Fraud protection/check validity verification

- Daily account reconciliation, monthly financial accounting, and reporting

- Treasury management and investment of funds within the QSF

- Tax return filings and 1099 issuance

- Access to local elder law and probate attorneys across the country

- Closing of the fund and interest reconciliation

Government Benefit Preservation

Claimants have much to consider regarding the financial implications of their settlements. Eligibility for government benefits is one of the most important issues many claimants must resolve.

Eligibility for Government Benefits

Needs-based government benefit programs use income and asset tests to determine eligibility. In most states, assets as low as $2,000 ($3,000 if married) are sufficient to render a claimant ineligible for most needs-based government benefits.

While entitlement benefits such as Medicare, Social Security Disability Income (SSDI) and Social Security Retirement Income will not be impacted by the settlement, there are many needs-based programs that would likely be affected, including:

- Supplemental Security Income (SSI)

- Medicaid (Medi-Cal in California)

- Supplemental Nutrition Assistance Program (SNAP)/Food Stamps

- Temporary Assistance for Needy Families (TANF)

- Subsidized Housing

- Children’s Health Insurance Program (CHIP)

What to Expect When You Work With Our Team

While some may assume that settlement proceeds should provide an adequate replacement for any lost benefits, the reality is that for many injured claimants, the loss of benefit coverage can be catastrophic. The compounding costs of medical procedures, medication, home modifications, attendant care and more can quickly deplete a settlement.

Our team works with injured claimants before finalizing the settlement to determine:

- Whether the claimant is currently eligible or expects to be eligible for needs-based government benefits in the near future; and

- If so, what the best course of action is to protect benefit eligibility and maximize the settlement proceeds.

Whether a Special Needs Trust or a spend down is the right solution, our consultants are here to walk claimants through every step of the process to protect important benefits and preserve their settlement proceeds.

Mass Tort Settlement Resolution

With projects that involve complex, ever-evolving compliance requirements, ethics rules, and legal and regulatory issues, it is imperative to have a team you can rely upon to properly resolve a mass tort claim.

That’s why many of the nation’s leading mass tort firms turn to our strategic partners to coordinate mass tort projects of varying sizes.

Scalable Mass Tort Solutions

CW Settlements partners with industry experts to offer scalable, customized solutions geared at ensuring law firm compliance, streamlining administration, minimizing costs, and reducing settlement funding time.

Whether the claimants are injured minors or adults, the ultimate goal is to ensure that every individual receives proper education about settlement options and potential issues that may arise.

Services include:

- Qualified Settlement Fund Administration

- Government Benefit Preservation

- Travel Coordination and Case Mapping

- Structured Settlements

- Market-Based Structured Settlements

- Trust Services

- Lien Resolution

- Claims Management

- Special Master / Guardian Ad Litem / Court Coordination

Medicare Set-Asides

For many claimants, negotiating the payment of future medical bills is an essential component of a favorable settlement. Claimants who currently receive Medicare or who expect to receive Medicare in the near future must follow specific guidelines when it comes to their future medical payments.

Medicare Secondary Payer provisions specify that Medicare will not pay for medical services related to a lawsuit when the proceeds include funds for future medical expenses until all such funds are properly expended. In other words, Medicare becomes the secondary payer to the settlement or award.

Medicare Set-Asides

A Medicare Set-Aside (MSA) is the government’s preferred method for protecting Medicare’s interests. A portion of the settlement is placed into an account to cover future medical costs related to the claimant’s injury. Once the account is depleted, the claimant can begin receiving Medicare payments again.

To create a proposal with a recommended allocation amount, the claimant’s estimated total cost of future medical care will be reviewed, as will the claimant’s medical history, including any pre-existing conditions, current treatments, physician statements, life expectancy, and other factors.

Criteria for Reviewing a Proposed Medicare Set-Aside

An expert can help determine the appropriate amount to “set aside” so that the MSA is not over- or under-funded. To date, the Centers for Medicare and Medicaid Services (CMS) have only released guidelines for reviewing Workers’ Compensation Medicare Set-Asides (WCMSAs).

CMS will only review WCMSA proposals that meet the following criteria:

- The claimant is a Medicare beneficiary, and the total settlement amount is greater than $25,000; or

- The claimant is not a Medicare beneficiary at the time of settlement but has a reasonable expectation of Medicare enrollment within 30 months of the settlement date, and the total settlement amount is greater than $250,000.

Within the past few years, CMS has also made advances on the Liability Medicare Set-Aside (LMSA) process. While official guidelines have yet to be released, CMS released a change request (which was modified and reissued on October 27, 2017) that indicates the following:

- Medicare Administrative and Recovery Contractors (MACs) may deny payment for items and services that should be paid from a Liability MSA (or No-Fault MSA);

- Medicare may deny payment for claims if it determines that the claims should have been paid by a liability insurance policy or another payer as outlined in the Medicare Secondary Payer (MSP) provisions; and

- Medicare is within its rights to seek reimbursement for expenses it has paid if those expenses should have been paid for out of the settlement or by another payer.

As guidance continues to unfold, it is imperative that attorneys and claimants work closely with a settlement planning expert to avoid Medicare issues. Failure to comply with Medicare Secondary Payer provisions may result in severe consequences for the attorney and the claimant.

Funding a Medicare Set-Aside

There are two methods of funding a Medicare Set-Aside: with a lump sum or with a structured settlement. The structured settlement option may allow the claimant to retain more of the settlement proceeds, as once the MSA funds are depleted each year, Medicare will cover any remaining injury-related medical costs until the structured settlement replenishes the MSA the following year1. Claimants who choose to fund an MSA with a lump sum payment must deplete the entire MSA before Medicare resumes paying for injury-related medical care.

1Claimants who choose the structured settlement option to fund an MSA must make an initial deposit of “seed money” in the amount of the first surgical procedure or replacement and two years of annual payments. The structured settlement will then fund the MSA with annual deposits. Any funds remaining in the MSA at the end of the annual period will be carried forward to the next period.

For more information about Medicare Set-Asides, contact us today.

Probate Coordination

Some claimants may be required to go through estate administration procedures to receive the distribution of settlement proceeds from a loved one’s estate. The probate process can be slow, and it involves reviewing the decedent’s assets and dividing them according to the law or the decedent’s wishes.

For claimants who do not wish to settle the estate themselves, we work closely with industry leaders to offer expert probate assistance. Our business partners will help coordinate probate matters and, if necessary, will assign local probate counsel from their national database of highly qualified legal counsel to help properly administer the estate.

Given how confusing and expensive the probate process can be, it can save you considerable time and money to engage an expert. Each estate is unique and potentially complex. Contact CW Settlements today and get a team behind you who will walk you through the process and connect you with competent counsel at a fair and reasonable cost.